michigan unemployment income tax refund

Check For The Latest Updates And Resources Throughout The Tax Season. For those who are entitled to a refund you will need to file an amended return in order to receive your refund.

It S Very Frustrating Bills From Uia Still Loom Over The Heads Of Many Michiganders

Unemployment compensation is generally included in adjusted gross AGI income under the IRC.

. Michigan taxpayers who qualify to receive a refund from the unemployment exclusion should file amended returns and claim the refund if they claimed a refund on their original return or paid any taxes due upon filing the original return. Therefore unemployment compensation is also included in Michigan taxable income. Inquire about an Assessment.

Michigan Confirms Unemployment Compensation is Taxable for Tax Year 2020. On May 17 2021. Unemployment compensation is treated as taxable income on the federal return and the Michigan income tax return.

Please allow the appropriate time to pass before checking your refund status. Inquire about My Refund. In most cases if you already filed a 2020 tax return that includes the full amount of your unemployment compensation the IRS will automatically determine the correct taxable amount of unemployment compensation and the correct tax.

Michigan residents now are looking at an extra long delay in receiving key tax paperwork from the state Unemployment Insurance Agency. If you dont receive a notice. Tax is normally required on unemployment benefits but the American Rescue Plan waived the first 10200 in unemployment income for people making less than 150000 annually.

Ad Premium federal filing is 100 free with no upgrades for unemployment tax filing. The State of Michigan has issued a decisionon the treatment of unemployment compensation for the 2020 tax year. People are filing their tax refunds and because things are clogged up for some of those people those can be garnished said Lisa Ruby a Michigan Poverty Law Program attorney.

If you qualify and filed a 2020 return without the 10200 unemployment compensation exclusion then YES you will most likely need to file an amended return. That means the average refund for one week of unemployment from last spring and summer would be roughly 40. Up to 10200 of unemployment benefits will tax exempt in conformity with IRS treatment.

But even as workers await the document the state has yet. The federal American Rescue Plan Act excludes unemployment benefits up to 10200 from. Inquire about Tax Preparation.

President Bidens recent federal American Rescue Plan Act excludes unemployment benefits of. Paula Gardner Email Business Watch. Michigan unemployment officials say 12 million residents about 25 percent of the states labor force should receive a 1099 tax form by the end of February a month late so they can file annual income taxes.

Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. If Your Refund is HeldOffset to Pay a Debt. The state UIA said Monday that 1099-G forms now will be sent.

2020 Home Heating Credit MI-1040CR-7 Standard Allowance. Allow 6 weeks before checking for information. Many people had the.

The Michigan Department of Treasury has posted a notice for taxpayers related to the treatment of unemployment compensation for tax year 2020. Michigan residents who lost their jobs in 2020 and filed their state income tax returns early this year need to file an amended state return to get extra cash back from a new tax break. Taxpayers eligible to receive a refund due to reporting the unemployment exclusion include taxpayers who claimed a refund on the original Michigan return and taxpayers who paid any tax due with the filing of that original return.

Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. Contact the IRS only if your original refund amount shown on the BFS offset notice differs from the. 4 Effect of the American Rescue Plan Act on the taxation of unemployment compensation.

Ad See How Long It Could Take Your 2021 State Tax Refund. Adjusted Gross Income AGI or Total Household. Inquire about Other Topics.

All individual income tax returns must be received by 1159 pm. Mortgage Foreclosure or Home Repossession and Your Michigan Individual Income Tax Return. Contact the BFSs TOP call center at 800-304-3107 or TDD 866-297-0517 Monday through Friday 730 am.

LANSING Michigan taxpayers who collected unemployment benefits and have not yet filed a state income tax return should file their returns as soon as they are able according to a news release from the Michigan Department of Treasury. Request a Copy of Tax Return. MoreMichigan jobless claimants wont get key tax form until end of February.

The federal American Rescue Plan Act was signed into law on March 11 2021. 2020 Home Heating Credit MI-1040CR-7 Alternate Credit Computation. The federal American Rescue Plan Act excludes unemployment benefits up to 10200 from income for tax year 2020 for those within certain income brackets providing tax relief on both federal and.

Allow 2 weeks from the date you received confirmation that your e-filed state return was accepted before checking for information. If you paid more than the correct tax amount the IRS will either refund the overpayment or apply it to other outstanding taxes owed. These taxpayers should file an amended Michigan income tax return to claim that refund.

Michigans state income tax is 425. The Michigan Department of Treasury withholds income tax refunds or credits for payment of certain debts such as delinquent taxes state agency debts garnishments probate or child support orders overpayment of unemployment benefits and IRS levies on individual income tax refunds. Should you file a Michigan amended return.

Request a Copy of Check. - Taxpayers who filed their state individual income tax returns and collected unemployment benefits in 2020 should consider filing an amended return if they havent yet received their entitled tax relief according to the Michigan Department of Treasury. Request a Copy of a Letter.

Home Heating Credit And Shared Housing Situations. Learn How Long It Could Take Your 2021 State Tax Refund. February 16 2022.

Where S My Refund Michigan H R Block

Michiganders Are Still Facing Steep Bills From An Unemployment Agency Error Experts Worry Their Tax Returns Could Be Seized Mlive Com

Michigan Pauses Debt Collection From Unemployment Mistake Weyi

Michigan Agency Disputes Motion That Asks Court To Block Collections On Pandemic Unemployment Bills Mlive Com

Leo How To Request Your 1099 G

Getting Familiar With Michigan Treasury Online Mto

Pin By Topnow In On Https Www Topnow In Electronic Products Electronics Phone

Garnishments Paused As Michigan Reviews Covid Unemployment Payments

Michigan Unemployment Benefits For Limited Liability Company Members Rehmann

Michigan Flagged Unemployment Recipients Won T Have To Repay Money Bridge Michigan

This Annual Tax Reference Guide Is For Any Business That Has Employees And Contractor Bookkeeping Business Small Business Accounting Small Business Bookkeeping

Hundreds Of Thousands Of Michiganders Receiving Unemployment Funds Impacted By State Error Wwmt

Some Families Face Paying Back Money To State That S Already Been Spent On Household Bills And Food

Inicio Mi Pareja Mi Espejo Self Help Online Security Self

Getting Familiar With Michigan Treasury Online Mto

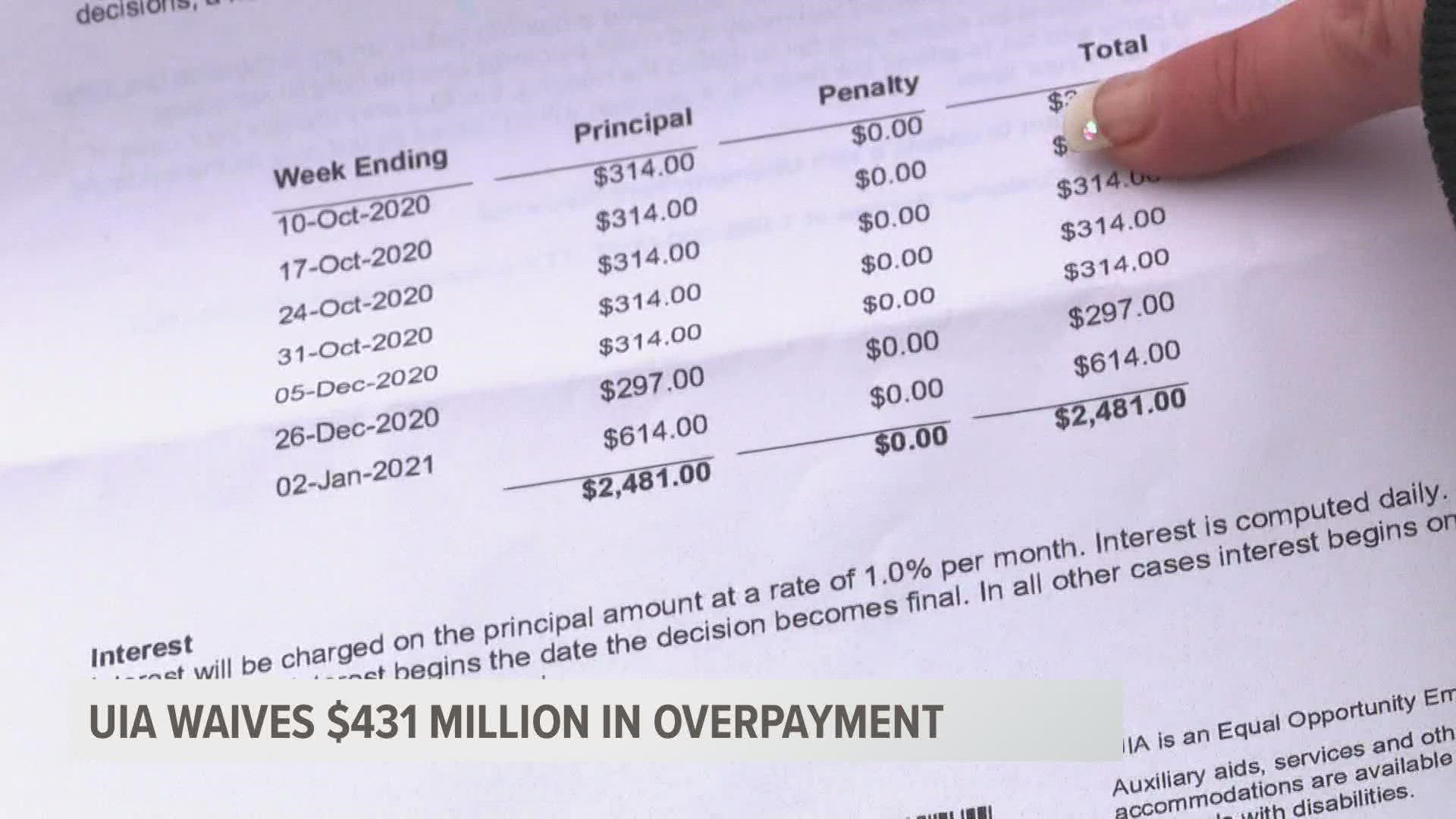

Michigan Uia Waives 431 Million In Overpayments Wzzm13 Com

Michigan S Uia Pauses Collections Against 400 000 Claimants With Overpayment Letters